The Monthly Donor Society recognizes a special network of supporters, people who have different stories with our organization but the same desire to sustain our programs!

Did you know that as many as two-thirds of companies in the United States might match donations according to America’s Charities’ Snapshot Employer Research?

Your company might be able to extend the impact of your giving through a matching gift program! If you are not aware of this program (many people are not), inquire with your HR office to see if your gift could be matched. AMIGOS EIN is 74-1547146. If you have any questions, email [email protected].

Current companies matching gifts to AMIGOS:

AbbVie

Apple INC

Arsenal Capital Partners

AT&T Inc.

Bill & Melinda Gates Foundation

Citgo Petroleum Foundation

Dell

Duke Energy Foundation

First Horizon

General Mills

Goldman Sachs & Co.

Google

Levi Strauss

Microsoft

Murphy Oil Corporation

Pfizer Inc.

Phillips 66

Rosewood Property Company

S&P Global

S2G Ventures

Salesforce

Shell Oil Company Foundation

Texas Instruments Foundation

VMWare Foundation

William and Flora Hewlett Foundation

AMIGOS has touched the lives of thousands of alumni, parents, chapter leaders, and supporters over the past five decades. A bequest or other legacy gift is a meaningful way to leave a legacy with an organization that has played an important role in your life.

The Guy Bevil Legacy Society is designed to create a communication channel between our legacy donors and the organization.

You may designate your gift toward the area of greatest need, financial assistance, the AMIGOS endowment, or a specific program. If you have already made a legacy gift, please let us know so we can recognize you as a society member.

The Guy Bevil Legacy Society Intention Form can be downloaded here. For questions, please contact the AMIGOS Fund Development Team at [email protected].

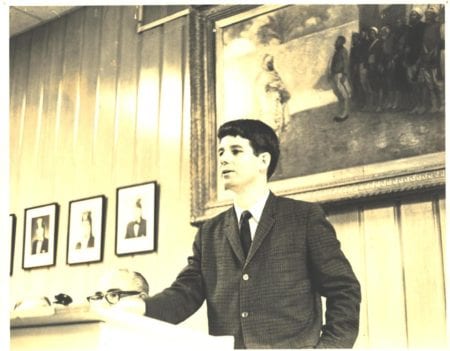

The Guy Bevil Legacy Society is named in honor of the founder of AMIGOS, Guy Bevil, who had the vision and drive to start the organization in 1965. We applaud Guy Bevil’s legacy as well as the foresight of our Legacy Society members who are securing our vision for future generations and the organization’s future success.

Douglass and Margaret Beeman

Phil Bratten

Elaine Granata

David Hill

Sara Nathan

Fiona Ortiz

Ann Sandford

Mary Stelletello and Andy Howick

Marvin Trotter

Emily Untermeyer

Dayton Voorhees

Anonymous (2)

“When my son passed away a few years ago, I searched for ways to remember him, an AMIGOS volunteer in Costa Rica in 1992. It did not take long for me to decide that donations and a legacy gift to AMIGOS would both help allay my grief and honor my son’s commitment to the AMIGOS mission. I also came to realize that my support for youth programs in Latin America had come to reflect, and expand upon, my own interests. Over many years, my trips to Costa Rica, Honduras, and Guatemala, while visiting my son, had shown me, up close, that young Americans abroad could both help others in need and build lifelong leadership skills grounded in community work experiences and relationship-building across cultures.

My commitment to AMIGOS has only grown as I have watched the organization respond to the need for innovative programs to meet challenges presented by the pandemic. I joined the Guy Bevil Legacy Society by committing to a legacy gift to help ensure that AMIGOS will thrive long into the future.”

–Ann Sandford, AMIGOS Parent (’92, ’93, ’94, ’99, ’00); 7/1/2021

“My life changed when Guy Bevil spoke at my church when I was 15. I went on survey with him the next spring and to Guatemala in ’68, ’69, and ’70, Honduras in ’71, and Paraguay in ’72. AMIGOS changed my view of the world by making me a better person with more compassion, empathy, and a desire to do for others. At the beginning of my career, I wanted to help my community by building a much-needed recreation center. Guy Bevil and AMIGOS taught me to have a vision and stick with it! With the help of many others, we raised $9 million and built a 20,000 sq. ft. Center. I joined the Guy Bevil Legacy Society by committing to a $50,000 legacy gift. My donation will contribute to the future of AMIGOS volunteers and communities throughout Latin America. When you make a legacy gift to AMIGOS, you are throwing rocks in a pond that causes multiple ripples.”

–Marvin Trotter, ’71, ’72; 08/28/2019

Amigos de las Américas is a 501(c)3 nonprofit organization. As such, we are not a professional financial advising organization. Any information found on this webpage does not constitute financial or legal advice. For financial and legal counsel, please consult your personal financial and legal advisers.

People of all types involved in our organization (staff, board, volunteers, alumni, etc.) can connect AMIGOS to funding sources. Through fundraising conducted by the AMIGOS Fund Development team and AMIGOS chapters, we raise nearly $2 million in giving each year to support our programs and students. With your individual story and personal connections, you can take part in this massive effort in a way that no one else can.

Ways you can assist in fundraising:

When you join AMIGOS, you become part of our family. The AMIGOS community is filled with changemakers who are supporting young leaders who join our programs. Hear from program alumni, their families, and educators as they discuss the impact of AMIGOS and their own stories.

Mateo Rojas, ’14, ’19,’21; 2/13/2022

My commitment to AMIGOS has only grown as I have watched the organization respond to the need for innovative programs to meet challenges presented by the pandemic. I joined the Guy Bevil Legacy Society by committing to a legacy gift to help ensure that AMIGOS will thrive long into the future.”

–Ann Sandford, AMIGOS Parent (’92, ’93, ’94, ’99, ’00); 7/1/2021

Learn how you can make a legacy gift and join Ann in the Guy Bevil Legacy Society here.

–Raquel Wexler, ’87; ’88; ’89; ’93; 10/19/20

“I believe in stretching youth to develop leadership skills early and in forging close personal relationships between youth throughout the Americas. AMIGOS does this well.”

–Scott Roberts, 7/22/20

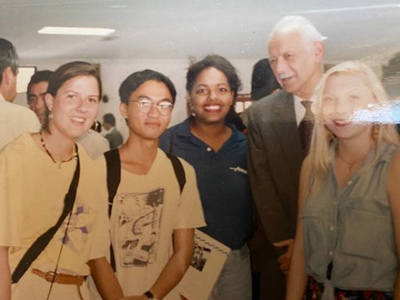

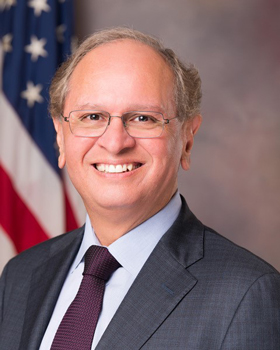

“My AMIGOS experience began in 1974 when I was a high school student in Denver, Colorado, and it lasted seven or eight years. I ended up, you know, of course being a Route Leader and a Project Director. I actually worked a year at the International Office here in Houston right after I graduated from college doing chapter development, so that was a lot of fun. And AMIGOS was so key in helping me figure out what I wanted to do. Initially, I thought, you know, it has to be medicine or public health, etc., but I actually met some really interesting diplomats, foreign service officers, and USAID officials in my AMIGOS work and, again, decided that was what I wanted to do. So that is what I ended up doing, and I have done that 37, 38, years now. I give back to AMIGOS because it was the most consequential experience of my youth and put me on the road to a wonderful career in public service. AMIGOS nurtured my passion and potential as an effective leader and manager and set the stage for my success as a Foreign Service Officer. Please pay it forward with a generous donation to AMIGOS so that the next generation of young leaders can do good and do well in service to others.”

–Ambassador Arnold Chacón, ’74; ’75; ’76; ’77; ’78; ’79; 7/13/2020

“AMIGOS taught me many very important lessons at a young age, but one that has most stuck with me is that given the tools to think critically about the world and themselves, youth are capable of things far beyond what their age suggests. I am proud to infuse that spirit into my work by encouraging my students to ask critical questions, develop self-awareness, and become strong self-advocates. I support AMIGOS so they can continue to empower and inspire as many youth leaders as possible.”

–Libby Udelson, ’08, ’09, ’11, ’12, ’14, ’17; 4/26/20

“I donated to AMIGOS because it was a way to help more teenagers go on this amazing experience. I received financial assistance to be able to attend my AMIGOS trip, and I just want to be able to help more students like me experience this journey.”

–Alexa Lara, ’19; 4/22/2020

“I donated because I got so much out of my participant experience and want others to be able to experience AMIGOS in the same capacity that I did.”

–Emma Link, ’15, ’16, ’17; 04/14/2020

“In the ’80s, I was the Director of Finance and Administration for AMIGOS. During my time there, 5 years, I had the chance to go to Mexico and Costa Rica and see the impact that AMIGOS makes on a community. I also saw a transformation in the volunteers. They went in young and inexperienced and came out mature and ready to make an impact on the world. In the interim, I have stayed in touch with AMIGOS, and I feel it is on us whose lives were impacted by AMIGOS to help the organization endure. Programs like this need to continue to be an option for young people.”

–Richard Nevins; 04/02/2020

“My life changed when Guy Bevil spoke at my church when I was 15. I went on survey with him the next spring and to Guatemala in ’68, ’69, and ’70, Honduras in ’71, and Paraguay in ’72. AMIGOS changed my view of the world by making me a better person with more compassion, empathy, and a desire to do for others. At the beginning of my career, I wanted to help my community by building a much-needed recreation center. Guy Bevil and AMIGOS taught me to have a vision and stick with it! With the help of many others, we raised $9 million and built a 20,000 sq. ft. Center. I joined the Guy Bevil Legacy Society by committing to a $50,000 legacy gift. My donation will contribute to the future of AMIGOS volunteers and communities throughout Latin America. When you make a legacy gift to AMIGOS, you are throwing rocks in a pond that causes multiple ripples.”

–Marvin Trotter, ’71, ’72; 08/28/2019

Learn how you can make a legacy gift and join Marvin in the Guy Bevil Legacy Society here.

In celebration of the first virtual Adelante Festival in September 2020, we documented three audio stories of connection and impact. If you are interested in sharing your AMIGOS story, contact [email protected].

The opinions expressed in these interviews do not represent the official opinions or views of Amigos de las Américas.

The Foundation for Amigos de las Américas was established in December 2003 as an independent 501 (c)(3) organization to support the youth leadership and sustainable development work of Amigos de las Américas (AMIGOS). The dream of creating the Foundation was born out of the desire to take full advantage of the opportunities available to AMIGOS to make a difference in both the lives of volunteers and our host communities.

The endowment enables AMIGOS to keep programs accessible to youth from diverse backgrounds and supports innovation for the future.

For questions about the endowment, please contact Jenny Claycombe, Managing Director of Development, at [email protected].

Kevin Lanier

Steve Cook

Steve Sharpe

Our commitment to access would not be possible without the support of our individual, corporate, and foundation donors. Their belief in our mission and their financial support enable us to continue inspiring lifelong leadership and shared global responsibility through our authentic and immersive programs. We are honored to recognize donors who supported AMIGOS at the national level with a monetary gift or an in-kind donation of $1,000 or greater in 2022.

Dovetail Impact Foundation

Impact Health Policy Partners

Fletcher Held Law

SCA Fund

Scott Family Fund

Arsenal Capital Partners

General Mills

H-E-B

Kiwanis Foundation of Houston

The Kauffman Foundation, Inc.

Wolff Family Foundation

League of Creative Minds, Academy of Debate and Diplomacy

MSB Cocayne Fund Inc.

Ann C. & C. Hamilton Sloan Family Foundation

Bill and Melinda Gates Foundation Matching Gifts Program

Capital Plus Financial

Everett Family Fund of the Greater Houston Community Foundation

Higginbotham Insurance Agency

Mann Family Foundation

MSB Cocayne Fund Inc.

Ann C. & C. Hamilton Sloan Family Foundation

Bill and Melinda Gates Foundation Matching Gifts Program

Capital Plus Financial

Everett Family Fund of the Greater Houston Community Foundation

Higginbotham Insurance Agency

Mann Family Foundation

Murphy Oil Corporation

Shell USA Company Foundation

Weatherspoon Charitable Foundation

Westwood Trust

White & Case LLP

To see AMIGOS corporate partners and to find opportunities for your company to support AMIGOS, visit our corporate partners web page here.

Alan Wolf and Margot Weinberg

Adolfo E. Jimenez and Ulrike Falkenberg

Amalia and Eliot Davidoff

Andrew Haas MD and Susan B. Seligman-Haas MD

Ann H. Sanford

Anne Morriss and Frances Frei

Arjun Chatterjee MD and Aimee Wilkin MD

Arnold and Alida Chacón

Art and Patti Rascon

Barb and Mark Wille

Barrett K. Sides

Bart and Ilene Putterman

Ben and Karen Cain

Bob and Donna Schutt

Brian and Sarah Austin

Bryan and Leanne Link

Bryn Faris

Carrie Rhodes-Nigam

Catherine and George Masterson

Catherine Arnold

Chad and Kellie Motsinger

Charles Evans

Chad and Kellie Motsinger

Christopher C. Johnson MD

Claudia and Nicola Volpi

Coert and Molly Voorhees

Crane and Ellen Curran

Daniel Ross and Janine Knudsen

David and Pamela Mann

David and Viviana Denechaud

David and Jo Quinto

Dayton and Sara Voorhees III

Dianne Langmade

Donald and Martha Freedman

Doug and Stacy Alexander

Ed and Cathy Frank III

Ed and Suky Cazier III

Elizabeth Blowers-Nyman and Jay Nyman

Eric and Cindy Arbanovella

Frank Tetreault, Jr. and Kathleen Rooney

Gaspar and Deborah (Katzman) Ximenes

George T. Scharffenberger

Lisa Pieper MD and Robert Garland MD

Eric Heli Denys MD and Sonja Sylvia Declercq MD

Frederick and Karen Hulting

Gerry and Jill Finkelstein

Howard Wright III and Kate Janeway

James Tysell

Jane Schussler and Michael King

Jennifer Brodsky and Kumar Dandapani

Jereme Axelrod

Jesse Huckins and Kate Paisley

Joseph and Peggy Bracewell

Justin and Elizabeth Nelson

Kelly Burkholder and Mary Bouley

Kelly E. McMullen MD and Daniel W. Bowles MD

Ken and Kelly Bernard

Kevin and Robin Lanier

Kim and Robert J. van Maren

Kirsten Tobey

Krisa P. Van Meurs and Peter Farmer

LaNoe Bolling Westheimer and Robert Westheimer

Laura Sharpe McCutchen and Roy M. McCutchen III

Marcia and Tom Faschingbauer

Mariela Poleo

Marvin and Cassandra Trotter

Jennifer Murphy and Matthew Brauer

Michael and Brenda Brombacher

Michael Gridley

Michael Hafner and Samantha Schnee

Michael Vaughn

Mike and Dana Kercheval

Mike and Patty Moore

Milt and Lisa Roney

Molly and Marco Abbruzzese

Patricia and Benjamin Grad

Patricia and Scott Nichols

Paul and Mary Nugent

Paul and Jennifer Reidy

Phil and Linda Johnson III

Richard and Alita Rogers

Robert and Mary Fusillo

Robert Lee

Samantha and Ben Krause

Sara Lamson Nathan and Andrew P. Nathan

Sarah and Ryan Collins

Sarah and Andrew Heck

Scott Horsley

Scott and Cathi Roberts

Sierra R. Hawthorne and Krishna Esteva

Stanley and Christine Lynch

Steve and Allyson Cook

Steve and Laura Otillar

Steve and Lisa Schafer

Steve and Susana Sharpe

Therese Atkinson

Toby and LaDeena Spoon

Tom Soraya Brombacher

D. Scott Smith & Phyllis C. Tien

Wade and Donna Lamson

Ed Frank Jr. (1921-2022)

Nancy Marshall (1934-2022)